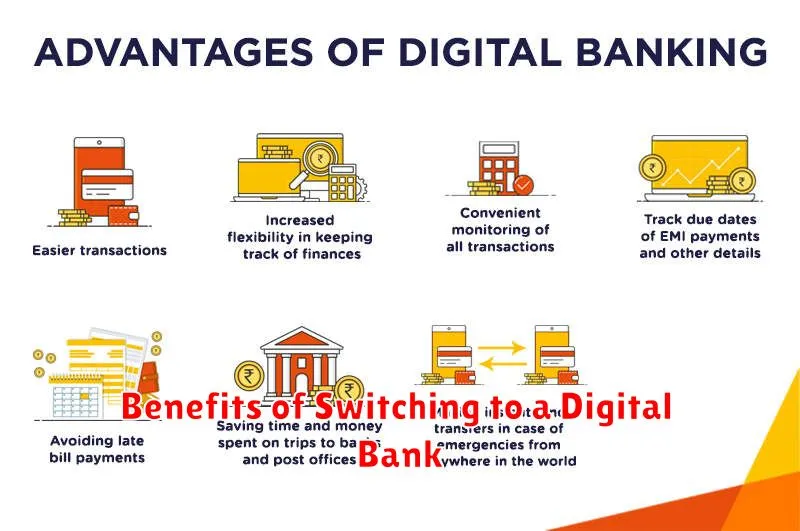

In today’s fast-paced world, managing finances efficiently and conveniently is paramount. Switching to a digital bank offers a plethora of benefits that can significantly enhance your financial life. From lower fees and higher interest rates to 24/7 account access and innovative budgeting tools, digital banks are transforming the way we interact with our money. Explore the numerous advantages of making the switch and discover how a digital bank can empower you to take control of your finances.

This article delves into the compelling reasons why transitioning to a digital bank can be a wise financial decision. We will examine the key benefits, such as reduced costs, increased earning potential, and enhanced accessibility, that set digital banks apart from traditional brick-and-mortar institutions. Discover how embracing the digital banking revolution can streamline your financial management and unlock a world of opportunities.

Lower Fees and Costs

One of the most significant advantages of digital banks is the potential for lower fees and costs. Traditional banks often have substantial overhead costs associated with maintaining physical branches. These costs are often passed on to customers through monthly maintenance fees, ATM fees, and other charges.

Digital banks, operating primarily online, typically have significantly lower operating costs. This allows them to offer accounts with reduced or even no monthly fees, free ATM access at a wider network of machines, and lower overdraft fees. These savings can add up significantly over time.

Enhanced Convenience and Accessibility

Digital banks offer unparalleled convenience, eliminating the need for physical branch visits. 24/7 access to your accounts through online platforms and mobile apps allows you to manage your finances anytime, anywhere.

This increased accessibility is especially beneficial for individuals with busy schedules or limited mobility. Features like mobile check deposits, instant money transfers, and real-time transaction alerts simplify everyday banking tasks.

Furthermore, digital banks often extend their services beyond basic banking. Many offer budgeting tools, spending trackers, and even investment platforms, all accessible within a single, unified interface.

Innovative Financial Management Tools

Digital banks often provide innovative financial management tools designed to simplify your financial life.

These tools may include budgeting and expense trackers that automatically categorize your spending, allowing you to easily visualize where your money goes. Some platforms even offer personalized financial advice based on your spending habits.

Real-time alerts for account activity, low balances, or unusual transactions empower you to stay on top of your finances and prevent potential issues. Many digital banks also include savings goals features, which can help you automate your savings and reach your financial objectives more efficiently.

Better Interest Rates and Rewards

One of the most compelling advantages of switching to a digital bank is the potential for higher interest rates on savings accounts and checking accounts. Traditional banks often have higher overhead costs, which can impact the interest rates they offer customers. Digital banks, with their streamlined online operations, can often pass those savings on to their customers in the form of better returns.

In addition to better interest rates, digital banks frequently provide attractive rewards programs. These programs can include cashback on purchases, discounts on services, or other perks designed to enhance the customer experience and provide additional value.

Seamless International Transactions

Traditional banks often impose high fees and unfavorable exchange rates for international transactions. Digital banks frequently offer more competitive exchange rates and significantly lower fees, sometimes even eliminating them altogether.

This advantage makes sending and receiving money internationally much more cost-effective. Whether you’re shopping online from overseas retailers, sending money to family abroad, or traveling internationally, a digital bank can simplify and reduce the cost of your international transactions.

Advanced Security Features

Digital banks often offer robust security measures exceeding those of traditional institutions. These include multi-factor authentication, requiring multiple verification steps to access accounts.

Biometric authentication, like fingerprint and facial recognition, adds another layer of protection. Real-time transaction alerts notify you of any activity, enabling quick identification of unauthorized access. Many digital banks also employ advanced encryption technology to safeguard your data.

Easy Integration with Financial Apps

Digital banks often provide seamless integration with various financial apps and services. This interconnectivity allows for a more streamlined management of your finances.

Connecting to budgeting apps, investment platforms, and other financial tools helps you gain a holistic view of your financial situation. This integration simplifies tasks such as tracking expenses, monitoring investments, and making informed financial decisions.

Effortless synchronization with these apps reduces manual data entry and ensures that your financial information is consistently updated across all platforms.

Faster and Easier Customer Service

Digital banks often provide 24/7 customer support through various channels, such as in-app chat, email, and sometimes even phone support. This eliminates the need to visit a physical branch and wait in line, saving you valuable time.

Many digital banks also offer robust FAQs and help centers within their apps, allowing you to quickly find answers to common questions and resolve issues independently. This self-service approach further streamlines the customer service experience.

Features like instant notifications for transactions and account updates keep you informed, minimizing the need to contact customer support for routine inquiries. This proactive communication contributes to a more seamless banking experience.

Flexible Account Management

Digital banks offer unparalleled flexibility when it comes to managing your finances. You can access your account 24/7 from anywhere with an internet connection.

This means you can check your balance, transfer funds, and even pay bills at your convenience, eliminating the restrictions of traditional banking hours.

Many digital banks also provide real-time transaction notifications, keeping you constantly informed about your account activity. This level of control and transparency empowers you to manage your money more effectively.

Environmental Impact Reduction

Switching to a digital bank offers a significant opportunity to reduce your environmental impact. Traditional banks consume vast amounts of resources for physical infrastructure, paper statements, and transportation. Digital banks, operating primarily online, minimize these dependencies.

By eliminating the need for paper statements and reducing travel to physical branches, digital banking contributes to lower paper consumption and decreased carbon emissions. This shift towards digital processes aligns with environmentally conscious practices and promotes a more sustainable financial ecosystem.