In today’s fast-paced digital world, managing your finances efficiently and conveniently is paramount. Choosing the right banking app can significantly impact your financial well-being, offering features that streamline transactions, enhance security, and provide valuable insights into your spending habits. This article will delve into the key features you should consider when selecting a banking app to ensure it aligns with your individual financial needs and preferences. We’ll explore aspects such as security, mobile check deposit, account alerts, bill pay, and customer support, empowering you to make an informed decision and select the perfect banking app.

Navigating the multitude of available banking apps can be overwhelming. With a variety of features and functionalities, it’s crucial to prioritize those that truly matter to you. Whether you prioritize robust security measures, seamless mobile check deposit capabilities, or proactive account alerts, understanding the core functionalities of different banking apps is essential. This guide will equip you with the knowledge to identify the essential features to look for, allowing you to choose a banking app that not only simplifies your financial life but also provides peace of mind.

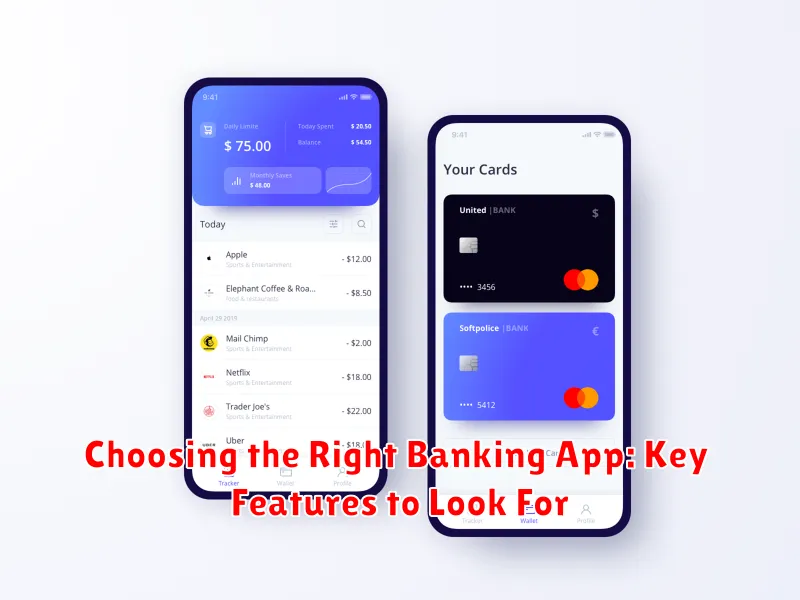

User-Friendly Interface

A user-friendly interface is crucial for a positive banking experience. Navigating through the app should be intuitive and easy, even for less tech-savvy users.

Look for an app with a clean design, clear labeling, and a logical flow between different functions. A well-designed interface minimizes frustration and allows you to manage your finances efficiently.

Consider whether the app offers customizable features, such as account nicknames or personalized dashboards. These options can further enhance usability and cater to individual preferences.

Essential Security Features

Security should be a top priority when choosing a banking app. Look for apps that offer multi-factor authentication (MFA). This adds an extra layer of security beyond just your username and password.

Biometric login, such as fingerprint or facial recognition, provides convenient and secure access. Ensure the app uses encryption to protect your data both in transit and at rest.

Fraud detection and alerts are also crucial. The app should proactively monitor your account for suspicious activity and notify you immediately of any potential threats.

Real-Time Account Updates

In today’s fast-paced world, staying on top of your finances is crucial. A banking app with real-time account updates provides immediate information about your transactions and balance. This feature eliminates the guesswork and helps you avoid overdrafts and other financial missteps.

Look for apps that offer instant notifications for deposits, withdrawals, and card payments. This level of transparency empowers you to monitor your spending effectively and maintain better control over your budget.

Real-time updates also contribute to enhanced security. By being instantly aware of any unauthorized activity, you can quickly take action to protect your account.

Budgeting and Financial Insights

Many modern banking apps offer built-in budgeting tools to help you track your spending and manage your finances effectively. Look for features that allow you to categorize transactions, set spending limits, and visualize your spending patterns with charts and graphs. Some apps even offer personalized financial advice and insights based on your spending habits.

Real-time expense tracking is another valuable feature. This allows you to see where your money is going as you make purchases, helping you stay on top of your budget. Some apps provide alerts for upcoming bills or when you are nearing your spending limits.

Payment and Transfer Options

A critical aspect of any banking app is the ease and flexibility of making payments and transfers. Look for an app that supports a variety of payment methods, including peer-to-peer (P2P) transfers, bill pay, and mobile check deposit.

Consider the speed of transfers. Does the app offer real-time or next-day transfers? Are there any fees associated with different transfer types? Transaction limits are also important to consider, especially if you frequently move large sums of money.

Customer Support Accessibility

Reliable and accessible customer support is crucial when choosing a banking app. Problems can arise at any time, and you need to know you can get assistance quickly.

Look for apps offering multiple support channels. These might include in-app chat, secure messaging, email, and phone support. Consider which methods you prefer and ensure the app offers them. Also, check the hours of availability. 24/7 support is ideal for handling urgent issues outside of regular business hours.

Integration with Other Financial Tools

Seamless integration with other financial tools is a crucial feature of a modern banking app. Consider whether the app connects with budgeting apps, investment platforms, or accounting software. This interconnectivity can simplify your financial management by providing a holistic view of your finances.

Look for apps that support features like automatic transaction importing and categorization. This can save you significant time and effort compared to manual entry. Integration with other tools can also facilitate more sophisticated financial planning and analysis.

Availability of Promotions and Rewards

When selecting a banking app, the availability of promotions and rewards can be a significant factor. Some apps offer cashback on certain purchases, while others provide discounts with partner merchants. Sign-up bonuses are also common enticements.

Consider the types of rewards that align with your spending habits. Are you looking for cashback, travel points, or other perks? Also, be mindful of any requirements or limitations associated with earning and redeeming rewards. Some programs may have expiring points or minimum redemption thresholds.

Compatibility Across Devices

In today’s interconnected world, seamless access to your banking information is crucial. Device compatibility is a key factor to consider when selecting a banking app. Ensure the app functions flawlessly across your various devices, whether it’s a smartphone, tablet, or computer.

Check if the app is available for your specific operating system (e.g., iOS, Android, Windows). Furthermore, consider the user experience on different screen sizes. A well-designed app should adapt seamlessly, providing a consistent and user-friendly experience regardless of the device used.

Reviews and User Feedback

User reviews and feedback provide valuable insights into the real-world performance and usability of a banking app. Reading reviews on app stores and other platforms can highlight both strengths and weaknesses that might not be apparent from marketing materials.

Pay close attention to recurring themes and complaints. A few negative reviews might be isolated incidents, but a pattern of similar issues suggests a deeper problem. Look for mentions of app stability, customer service responsiveness, and the clarity of the user interface.

Consider the source of the reviews as well. Reviews from long-term users can offer a different perspective than those from new users. It’s also beneficial to look at the developer’s responses to negative reviews, as this can indicate their commitment to addressing user concerns and improving the app.