In today’s fast-paced digital world, digital banks are revolutionizing the financial landscape. Choosing the right one can significantly impact your financial well-being. This article explores the key features you should consider when selecting a digital bank. From security measures and fee structures to customer service and innovative features, understanding these key aspects will empower you to make an informed decision and choose the digital bank that best suits your needs.

Navigating the numerous digital banking options available can be overwhelming. This guide simplifies the process by highlighting the essential features to prioritize. Whether you’re looking for a digital bank with robust mobile banking capabilities, competitive interest rates, or comprehensive financial management tools, understanding these key features will help you identify the ideal digital bank to meet your financial goals. Discover the essential elements that differentiate the top digital banks from the competition and empower yourself to make a sound financial decision.

Robust Security Features

Security is paramount when choosing a digital bank. Look for multi-factor authentication (MFA) as a baseline. This adds an extra layer of protection beyond just a username and password.

Biometric authentication, such as fingerprint or facial recognition, offers increased security and convenience. Ensure the bank utilizes encryption to protect data both in transit and at rest. A strong track record of security practices and certifications is also a key indicator of a trustworthy digital bank.

Consider whether the bank offers features like fraud detection and real-time transaction alerts. These tools empower you to monitor your account actively and identify any suspicious activity promptly.

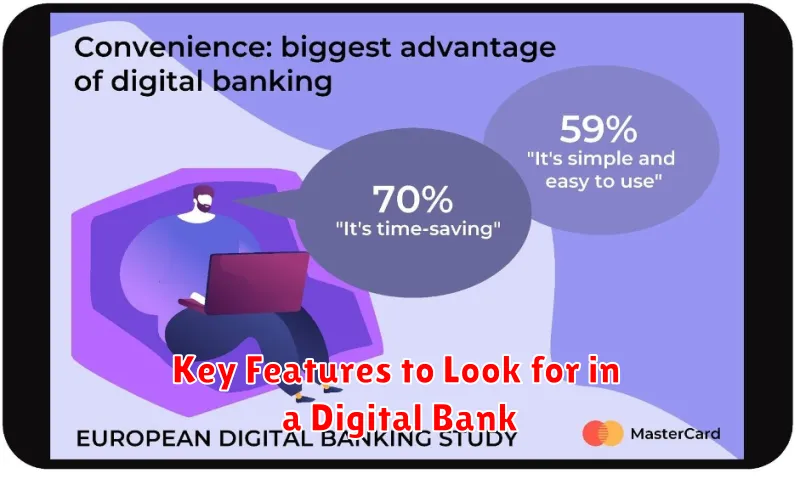

User-Friendly Interface

A critical aspect of a positive digital banking experience lies in its user interface. A well-designed interface should be intuitive and easy to navigate, even for those less tech-savvy. Look for features like clear menus, straightforward transaction processes, and readily accessible account information.

Efficiency is key. You should be able to accomplish tasks quickly and with minimal clicks or taps. A cluttered or confusing interface can lead to frustration and wasted time. Consider whether the interface offers personalization options, allowing you to customize the view and features to match your specific needs.

Fee Transparency

Transparency regarding fees is a crucial aspect of a reputable digital bank. You should easily be able to find information about any and all potential fees associated with your account.

Look for clear disclosures about monthly maintenance fees, overdraft charges, ATM fees, and any other costs you might incur. A good digital bank will present this information clearly and concisely, without hiding it in fine print. This allows you to make informed decisions about your finances and avoid unexpected charges.

Comprehensive Mobile App

A robust and user-friendly mobile application is paramount for a modern digital bank. It serves as the primary interface for managing finances on the go. Look for an app that provides secure access to your accounts, allows you to easily transfer funds, pay bills, and deposit checks.

Key features of a comprehensive mobile banking app include real-time transaction notifications, budgeting tools, card management options (locking/unlocking), and customer support access.

Integration with Other Financial Tools

Seamless integration with other financial tools is a crucial feature of a modern digital bank. This interoperability allows for a more holistic view of your finances.

Look for compatibility with budgeting apps, accounting software, and investment platforms. This integration can simplify tasks such as tracking expenses, managing investments, and analyzing your overall financial health. A digital bank that works well with your existing tools can significantly improve your financial management efficiency.

Customer Support Quality

Reliable and accessible customer support is crucial in the digital banking landscape. Look for institutions offering multiple support channels such as in-app chat, email, and phone support, ideally with 24/7 availability.

Assess the quality of support by researching customer reviews and testimonials. Quick response times, helpful and knowledgeable representatives, and efficient issue resolution are key indicators of a strong customer support system. A well-designed FAQ section and other self-service resources can also significantly enhance the customer experience.

Flexibility and Accessibility

Flexibility and accessibility are crucial features of a modern digital bank. A flexible digital bank adapts to your lifestyle, offering services accessible anytime, anywhere. Look for features like 24/7 account access, mobile check deposits, and real-time transaction notifications.

Convenient access to customer support is also key. Does the bank offer multiple channels for support such as in-app chat, email, or phone support? The availability of these options contributes significantly to the overall accessibility of the bank.

Innovative Financial Solutions

A key aspect of a modern digital bank lies in its ability to offer innovative financial solutions beyond traditional banking services. This can include features like personalized budgeting tools that analyze spending patterns and provide tailored financial advice.

Look for features such as automated savings plans that effortlessly transfer funds towards specific goals. Early direct deposit access can also be a significant advantage, allowing you to access your paycheck funds sooner than traditional banks.

Some digital banks also offer investment options directly within their platform, streamlining the process of managing your finances. Consider whether the bank provides features like micro-investing or access to robo-advisors.

Reliable Uptime and Performance

Consistent access to your financial information and the ability to conduct transactions is paramount in a digital banking platform. Look for providers that offer a high uptime guarantee. This minimizes disruptions and ensures you can manage your finances whenever needed.

Performance is also crucial. Slow loading times and lag can be frustrating. A reliable digital bank should provide a seamless and responsive user experience, regardless of transaction volume or time of day. This includes quick processing of transactions and real-time updates on balances and account activity.

Regulatory Compliance and Trustworthiness

Regulatory compliance is a critical factor when choosing a digital bank. Ensure the bank is licensed and regulated by the appropriate authorities in your jurisdiction. This oversight provides a level of consumer protection, including deposit insurance and adherence to strict operational standards.

Look for indicators of trustworthiness, such as transparent communication about fees and policies. A strong track record, positive customer reviews, and robust security measures are all essential for establishing confidence in a digital banking platform.