Digital banking has revolutionized how we manage our finances, offering unparalleled convenience and accessibility. From checking account balances to paying bills and even applying for loans, digital banking platforms provide a comprehensive suite of financial services at our fingertips. This transformative shift in the financial landscape presents numerous advantages, including 24/7 account access, faster transactions, and often lower fees compared to traditional banking. However, the transition to a primarily digital financial experience also raises important considerations regarding security, privacy, and accessibility for all demographics. Understanding the full spectrum of digital banking, including its pros, cons, and everything in between, is crucial for navigating the modern financial world effectively.

This article explores the multifaceted realm of digital banking, delving into its various pros and cons. We will examine the benefits of digital banking, such as enhanced convenience, reduced costs, and increased efficiency. We will also analyze the potential drawbacks, including security risks, privacy concerns, and the digital divide. By providing a comprehensive overview of digital banking, from its advantages and disadvantages to its potential future implications, we aim to empower readers with the knowledge they need to make informed decisions about their financial well-being in the digital age. This discussion will encompass everything from basic online banking functionalities to more advanced features like mobile check deposits and peer-to-peer payments, ultimately covering the complete spectrum of what digital banking has to offer.

Accessibility and Ease of Use

Digital banking offers unparalleled convenience. Managing finances from anywhere, at any time, is a significant advantage. Transactions like checking balances, transferring funds, and paying bills are significantly streamlined through user-friendly apps and websites.

This 24/7 availability eliminates the need for physical branch visits, saving time and effort. Furthermore, digital banking platforms often provide helpful tools for budgeting, expense tracking, and financial planning, empowering users to take greater control of their finances.

Cost-Effectiveness of Digital Banks

Digital banks often boast greater cost-effectiveness compared to traditional brick-and-mortar institutions. This is largely due to their significantly lower overhead costs. They don’t require physical branches, reducing expenses associated with rent, utilities, and staffing. This allows them to offer competitive interest rates on savings accounts and lower fees for various services.

Customers benefit from potentially higher interest rates on savings and reduced fees on everyday transactions. Digital banks can pass on these savings directly to consumers. While the specifics vary between institutions, the potential for increased returns and reduced expenses is a significant draw for many customers.

Security Considerations

Security is paramount in digital banking. Phishing, malware, and data breaches are potential threats. Choose banks with robust security measures like multi-factor authentication (MFA) and strong encryption.

Regularly monitor your accounts for suspicious activity. Use strong, unique passwords and be cautious of suspicious emails or links. Keep your devices and software updated with the latest security patches.

Lack of Physical Branches

A primary characteristic of digital banks is the absence of physical branches. This can be a significant drawback for customers who prefer in-person banking services. Tasks such as depositing cash, complex financial consultations, or resolving intricate account issues can be more challenging without a physical location.

While some digital banks partner with shared ATM networks or retail locations for limited cash handling, the overall experience necessitates a higher degree of digital literacy and comfort. Customers who rely on face-to-face interaction may find this aspect of digital banking inconvenient.

Tech Support and Customer Service

Reliable and accessible customer service is crucial in digital banking. Customers may encounter technical difficulties, have questions about features, or require assistance with transactions.

Digital banks often offer support through various channels, including email, chatbots, and phone support. The quality and availability of these services can significantly impact the customer experience.

Effective tech support should be prompt, efficient, and able to resolve issues quickly. A well-designed FAQ section can also empower customers to troubleshoot common problems independently.

Advanced Financial Management Tools

Digital banking platforms often provide advanced financial management tools beyond basic transactions. These tools empower users to take greater control of their finances.

Budgeting and Expense Tracking: Many platforms offer automated budgeting tools that categorize spending and track expenses against predefined limits. These features can provide valuable insights into spending habits.

Investment Management: Some digital banks provide access to investment platforms, allowing users to manage investments, research potential opportunities, and execute trades directly through their banking app.

Financial Planning Tools: Certain platforms offer basic financial planning resources, such as retirement calculators or savings goal trackers, to assist users in achieving their long-term financial objectives.

Potential for Technical Issues

Digital banking, while convenient, isn’t immune to technical difficulties. System outages, software glitches, and website crashes can disrupt access to accounts and funds. These issues can be especially frustrating during urgent situations.

Security breaches and cyberattacks pose a significant risk. While banks employ robust security measures, vulnerabilities can be exploited, potentially leading to compromised accounts and financial losses.

Compatibility issues with different devices or operating systems can also arise. Ensuring smooth functionality across various platforms is an ongoing challenge.

Instant Transaction Processing

One of the most significant advantages of digital banking is the speed of transaction processing. Transactions are typically processed instantly, meaning funds are available immediately. This eliminates the delays associated with traditional banking, where check clearing and other processes can take several business days.

This real-time processing is particularly beneficial for businesses that require immediate access to funds or individuals who need to make time-sensitive payments. It facilitates quicker payments to vendors, faster salary deposits, and immediate access to funds for everyday expenses.

Transparency and Control Over Finances

Digital banking offers unprecedented transparency into your financial activity. Real-time updates on transactions, balance inquiries, and spending breakdowns are readily available through user-friendly interfaces. This empowers users to monitor their finances closely and identify potential issues quickly.

Furthermore, digital banking tools often provide budgeting features and spending trackers, enabling users to gain better control over their money. Automated alerts for low balances, upcoming bills, or unusual activity can help prevent overdrafts and maintain financial stability. These features promote financial literacy and responsible spending habits.

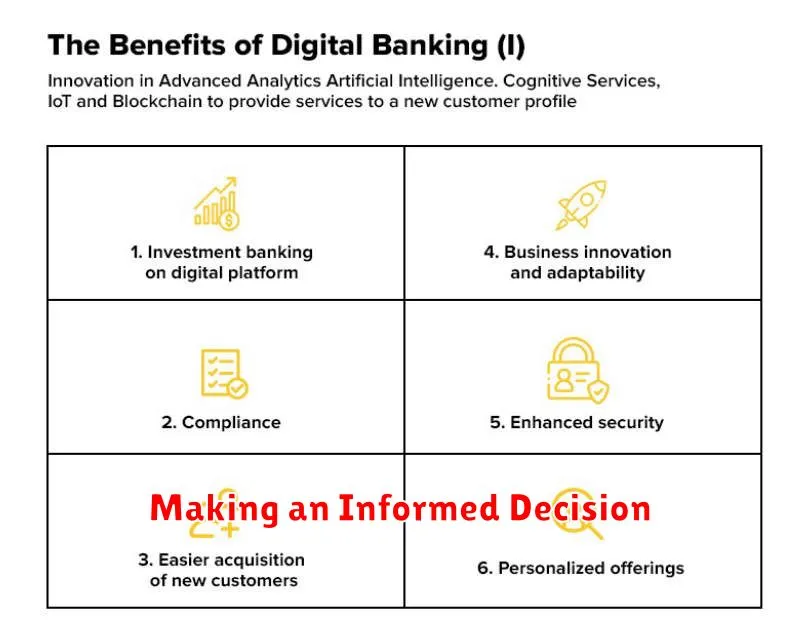

Making an Informed Decision

Choosing the right digital banking platform requires careful consideration of your individual needs and financial habits. Security is paramount, so prioritize institutions with robust security measures like two-factor authentication and encryption. Fees can significantly impact your finances, so compare monthly maintenance fees, overdraft charges, and ATM fees.

Features offered vary widely, from budgeting tools and mobile check deposit to virtual cards and international money transfers. Consider which features align with your banking style. Finally, assess the customer service options available, including phone support, email, and chat, to ensure you can easily access assistance when needed.