In today’s increasingly digital world, online banking offers unparalleled convenience. However, this convenience comes with inherent risks. Protecting your financial information is paramount. This article provides essential security tips for digital banking users to help safeguard their accounts and sensitive data from cyber threats. Understanding and implementing these security measures is crucial in the fight against fraud and identity theft. From creating strong passwords to recognizing phishing scams, we’ll cover vital steps to enhance your online security.

Whether you’re a seasoned online banker or just starting, staying informed about the latest security threats is essential. This guide covers a range of essential security tips, including advice on secure browsing practices, multi-factor authentication, and recognizing suspicious activity. By adopting these practices, you can significantly reduce your risk of becoming a victim of cybercrime while enjoying the benefits of digital banking. Take control of your financial security and learn how to protect yourself effectively.

Creating Strong and Unique Passwords

Strong passwords are the first line of defense against unauthorized access to your digital banking accounts. A strong password is one that is difficult for others to guess or crack using automated tools.

Follow these guidelines to create strong, unique passwords:

- Length: Aim for at least 12 characters.

- Complexity: Use a mix of uppercase and lowercase letters, numbers, and symbols.

- Uniqueness: Avoid using the same password for multiple accounts.

- Avoid Personal Information: Don’t use easily guessable information like your name, birthdate, or pet’s name.

Consider using a password manager to securely store and generate complex passwords.

Importance of Two-Factor Authentication

Two-factor authentication (2FA) adds a crucial extra layer of security to your digital banking accounts. It requires not only your password but also a second verification factor, making it significantly harder for unauthorized access even if your password is compromised.

This second factor typically comes in a few forms: a unique code sent to your phone via text message, a one-time code generated by an authenticator app, or biometric verification like fingerprint scanning. By requiring two distinct elements for authentication, 2FA significantly reduces the risk of fraud and unauthorized account access.

Activating 2FA on your digital banking accounts provides strong protection against various online threats, safeguarding your sensitive financial information.

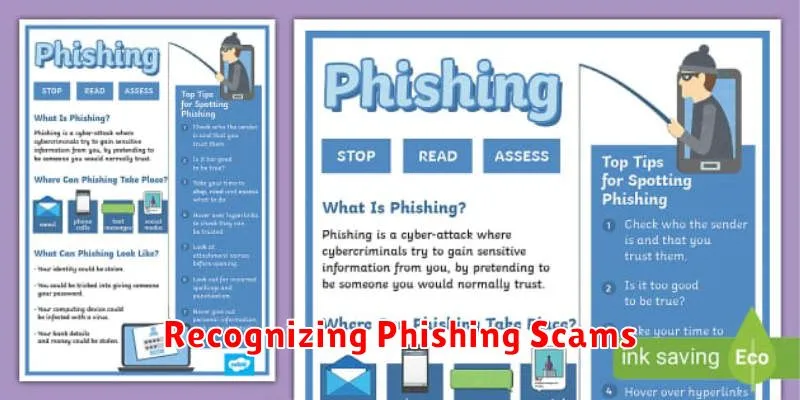

Recognizing Phishing Scams

Phishing scams are attempts to trick you into revealing sensitive information, such as your online banking credentials. Be wary of emails, text messages, or phone calls that appear to be from your bank but request personal information.

Key indicators of a phishing attempt include:

- Suspicious sender addresses: Check the email address carefully. It may look similar to your bank’s address, but have slight variations.

- Urgent requests: Phishing messages often create a sense of urgency, pressuring you to act quickly without thinking.

- Generic greetings: Legitimate communications from your bank typically address you by name.

- Requests for login credentials: Your bank will never ask for your username, password, or PIN via email, text, or phone.

- Suspicious links: Do not click on links in unsolicited emails or texts. Instead, type your bank’s web address directly into your browser.

Securing Mobile Banking Apps

Mobile banking offers unparalleled convenience, but it’s crucial to prioritize security. Always download your banking app from the official app store (Apple App Store or Google Play Store) to avoid counterfeit apps. Verify the app’s developer information before installation.

Enable strong authentication features like biometrics (fingerprint or facial recognition) or a strong, unique passcode. Avoid using simple PINs or patterns. Regularly update your banking app to benefit from the latest security patches.

Be wary of using public Wi-Fi for mobile banking. These networks can be insecure. If you must use public Wi-Fi, consider using a virtual private network (VPN) for added security.

Monitor your account activity frequently for any unauthorized transactions. If you notice anything suspicious, contact your bank immediately.

Regularly Monitoring Your Accounts

Regular account monitoring is crucial for early detection of suspicious activity. This simple practice can significantly reduce the impact of fraud and identity theft. Make it a habit to review your account statements, at least monthly, for any unauthorized transactions.

Look for anything unusual, such as unfamiliar payments, withdrawals, or changes to your personal information. Timely identification of a problem allows you to contact your bank immediately and take the necessary steps to secure your account.

Utilizing online banking tools, such as transaction alerts, can also enhance your security. Set up alerts for specific transaction types or amounts to receive real-time notifications of activity on your account.

Protecting Personal Information

Protecting your personal information is paramount in the digital age, especially when it comes to online banking. Never share your banking details (username, password, PIN, etc.) with anyone, including bank personnel. Legitimate institutions will never request this information via email, phone, or text message.

Be wary of phishing attempts. These often appear as legitimate communications from your bank, but aim to steal your credentials. Verify the sender’s address carefully and contact your bank directly if you suspect a phishing attempt.

Secure your devices. Use strong, unique passwords for all your online accounts and enable multi-factor authentication whenever possible. Keep your devices updated with the latest security software and operating system patches.

Using Secure Networks

Avoid using public Wi-Fi networks for digital banking. These networks are often unsecured, making your data vulnerable to interception by cybercriminals. Always opt for a secure, private network connection when accessing your financial information.

If you must use public Wi-Fi, consider using a Virtual Private Network (VPN). A VPN encrypts your internet traffic, adding an extra layer of security and making it more difficult for hackers to steal your data.

At home, ensure your Wi-Fi network is password-protected with a strong, unique password. Regularly update your router’s firmware to patch any known security vulnerabilities.

Keeping Devices Updated

Maintaining up-to-date software and operating systems on all your devices is crucial for digital banking security. Regular updates patch security vulnerabilities that cybercriminals could exploit to gain access to your financial information.

Enable automatic updates whenever possible. This ensures your devices receive the latest security patches promptly. For manual updates, schedule regular checks and install them as soon as they are available.

This applies to all devices used for digital banking, including computers, smartphones, and tablets.

Reporting Suspicious Activity Quickly

Swift action is crucial when you suspect unauthorized access or fraudulent activity in your digital banking accounts. Time is of the essence in mitigating potential losses.

If you notice any unusual transactions, login attempts from unfamiliar locations, or receive suspicious communications purporting to be from your bank, report it immediately. Your bank’s customer service number is the first point of contact.

Be prepared to provide specific details of the suspicious activity, such as transaction dates, amounts, and any other relevant information. Document everything for your records.

Understanding Bank Security Policies

Bank security policies are crucial for protecting your financial information. These policies outline the measures banks take to safeguard customer accounts and data from unauthorized access, fraud, and other security threats. Familiarizing yourself with these policies is an essential step in ensuring your online banking safety.

Key aspects often covered include authentication procedures, such as strong passwords and multi-factor authentication. Policies may also detail the bank’s fraud detection systems and how they monitor for suspicious activity. Understanding these systems can help you recognize potential threats and respond appropriately.

Additionally, policies often address data encryption and storage practices, as well as the bank’s responsibility in case of a security breach. By understanding these policies, you become a more informed and proactive participant in your own financial security.