In today’s rapidly evolving financial landscape, the choice between digital banking and traditional banking is a significant decision. This article delves into the core differences between these two banking models, examining their respective advantages and disadvantages to help you determine which option best aligns with your financial needs and preferences. We will explore key aspects such as accessibility, fees, security, and customer service, providing a comprehensive comparison of digital banking vs. traditional banking.

Navigating the complexities of digital banking vs. traditional banking can be challenging. Understanding the nuances of each system is crucial for making informed financial decisions. This article will provide a clear and concise overview of both digital banks and traditional banks, highlighting their distinct features and functionalities. We will cover topics ranging from online account management and mobile banking to physical branch access and in-person customer support, offering a balanced perspective to help you answer the question: Which is better, digital banking or traditional banking?

Accessibility and Convenience

A key differentiator between digital and traditional banking lies in accessibility and convenience. Digital banking offers 24/7 account access from anywhere with an internet connection. This eliminates the need for physical branch visits and expands banking availability beyond traditional business hours.

Traditional banking, conversely, requires customers to adhere to branch operating hours and, for certain transactions, necessitates in-person visits. While some traditional banks offer online and mobile banking options, the scope of services available digitally may be more limited compared to fully digital platforms.

Fees and Charges Comparison

A key differentiator between digital and traditional banking lies in their fee structures. Digital banks often boast lower or even non-existent fees. They typically eliminate monthly maintenance fees, minimum balance requirements, and overdraft charges. Traditional banks, conversely, frequently maintain these fees, potentially leading to higher costs for customers.

ATM fees are another point of comparison. While digital banks might reimburse ATM fees charged by other institutions, traditional banks may impose their own ATM fees, especially for out-of-network transactions.

| Fee Type | Digital Bank | Traditional Bank |

|---|---|---|

| Monthly Maintenance | Often Free | Potentially Charged |

| Minimum Balance | Often None | Potentially Required |

| Overdraft | Often Lower/None | Potentially Higher |

| ATM Fees | Often Reimbursed | Potentially Charged |

Interest Rates and Financial Benefits

A key differentiator between digital and traditional banking lies in the interest rates and financial benefits offered. Digital banks often offer higher interest rates on savings accounts and certificates of deposit (CDs) compared to traditional brick-and-mortar institutions. This is primarily due to their lower overhead costs.

Traditional banks, while sometimes offering competitive rates for certain premium accounts, generally provide lower interest rates on standard savings accounts. They may, however, offer a wider array of financial products and services, such as investment advisory services and wealth management, not always available through digital-only platforms.

Fees are another important consideration. Digital banks typically charge lower or no monthly maintenance fees, overdraft fees, and ATM fees. Traditional banks, conversely, often have a variety of fees, which can impact overall returns.

Customer Service Experience

A key differentiator between digital and traditional banking lies in customer service experience. Traditional banks offer face-to-face interactions at physical branches, providing a personalized experience for some. However, this is often limited by branch operating hours.

Digital banks primarily offer customer support through online channels such as email, chat, and phone. While convenient 24/7 access is a major advantage, some customers may prefer the in-person connection of traditional banking.

Ultimately, the “better” experience is subjective and depends on individual customer needs and preferences. Those valuing personalized advice and in-person interaction may prefer traditional banks. Those prioritizing 24/7 availability and digital convenience may favor digital banks.

Security Features Analysis

Security is a paramount concern in both digital and traditional banking. Traditional banks rely on physical security measures, such as vaults and armed guards, along with established fraud detection protocols.

Digital banking platforms employ multi-factor authentication, encryption, and biometrics for enhanced security. While digital platforms are susceptible to cyber threats, traditional banks remain vulnerable to physical robberies and fraud. Both systems continually evolve to combat emerging security risks.

Technology Integration and Innovation

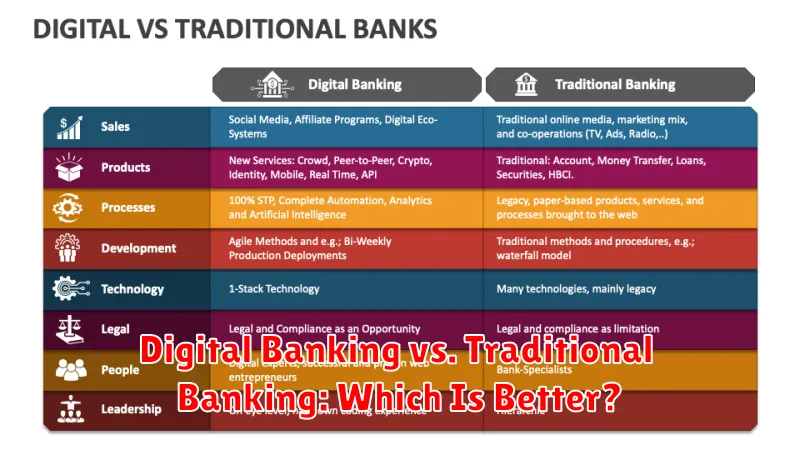

A key differentiator between digital and traditional banking lies in their approach to technology. Digital banks are built on a foundation of modern technology, allowing for seamless integration of new features and services. This agility translates to a faster pace of innovation, providing customers with cutting-edge tools for managing their finances.

Traditional banks, while adopting technology, often face challenges integrating it with legacy systems. This can lead to a slower pace of innovation and a less streamlined customer experience. They may offer some digital services, but the core infrastructure often lags behind the capabilities of fully digital platforms.

Physical Branches vs. Online Access

A key difference between digital and traditional banking lies in how you access your accounts. Traditional banking relies on physical branches. This provides in-person service and the ability to handle complex transactions with assistance. However, it requires traveling to a specific location during operating hours.

Digital banking emphasizes online access. This offers 24/7 account management from anywhere with an internet connection. While convenient, it can be challenging for those who prefer in-person interaction or require assistance with more complicated banking needs.

Ease of Account Management

Managing your finances is significantly impacted by the type of banking you choose. Digital banking offers unparalleled convenience, allowing 24/7 account access, instant transaction viewing, and often, robust budgeting tools. This level of control empowers users to actively monitor their spending and savings with ease.

Traditional banking, while offering in-person support, often lacks the immediacy and accessibility of digital platforms. Tasks like checking balances or transferring funds typically require a branch visit or ATM access, making account management more time-consuming.

Financial Tools and Resources

Both digital and traditional banks offer a range of financial tools and resources to help customers manage their finances. Budgeting tools, expense trackers, and financial planning resources are often available through online platforms or mobile apps.

Traditional banks may offer in-person financial advice and access to investment services. Digital banks frequently provide real-time transaction notifications and personalized financial insights driven by data analysis. The availability and sophistication of these tools can vary significantly between institutions.

Deciding the Best Fit for Your Needs

Choosing between digital and traditional banking depends entirely on your individual circumstances and priorities. Consider your comfort level with technology. If you prefer in-person interactions and established processes, a traditional bank might be a better fit.

However, if you value 24/7 access, lower fees, and the convenience of managing your finances from anywhere, digital banking might be more appealing. Think about your banking habits and needs. Do you frequently travel? Do you prefer to deposit checks digitally? These factors will play a significant role in determining which option best aligns with your lifestyle.

Carefully evaluate the features and services offered by both digital banks and traditional institutions. Consider things like overdraft fees, ATM access, and customer service options. Ultimately, the best choice is the one that best supports your financial goals and provides the peace of mind you need.