In today’s fast-paced world, digital banking apps have become essential tools for managing finances. Choosing the right app can significantly impact your financial well-being. This article explores the top features of effective digital banking apps, providing you with the knowledge necessary to make an informed decision. From robust security measures to seamless transaction management and innovative personal finance tools, we’ll delve into the key elements that distinguish a truly exceptional digital banking experience.

Understanding the core functionalities of leading digital banking apps empowers users to take control of their finances. We’ll examine features like real-time balance checks, mobile check deposits, peer-to-peer (P2P) transfers, and bill pay functionality. Furthermore, we’ll discuss the importance of customer support accessibility and the role of personalized financial management tools in optimizing your financial health within a secure and user-friendly digital banking environment.

User-Friendly Interface

A critical aspect of any successful digital banking app is a user-friendly interface. This means the app should be intuitive and easy to navigate, even for users less familiar with technology. Simplicity is key. Users should be able to quickly access the features they need without unnecessary complexity.

Clear visual hierarchy, concise labeling, and streamlined workflows all contribute to a positive user experience. A well-designed interface minimizes cognitive load, allowing users to efficiently manage their finances with ease and confidence.

Robust Security Features

Security is paramount in digital banking. Effective apps employ multi-factor authentication (MFA) to verify user identity. This might include passwords, one-time PINs sent via SMS, or biometric authentication like fingerprint or facial recognition.

Data encryption is another crucial feature. It safeguards sensitive information during transmission and storage, protecting it from unauthorized access. Look for apps that utilize robust encryption protocols.

Real-time transaction monitoring and fraud detection mechanisms are essential for preventing unauthorized activity. These systems can identify suspicious transactions and alert users promptly.

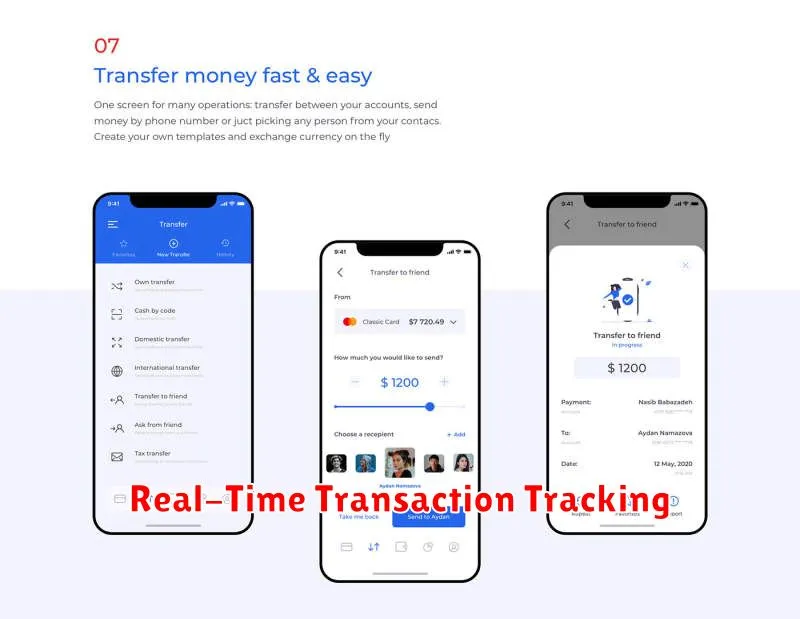

Real-Time Transaction Tracking

One of the most valuable features of a modern digital banking app is real-time transaction tracking. This functionality empowers users with up-to-the-minute information regarding their financial activities.

Instead of waiting for monthly statements, users can instantly see where their money is going. This provides greater control over finances and allows for quick identification of any unauthorized transactions or errors.

Real-time updates can include details such as the merchant, date, time, and amount of each transaction. This level of transparency promotes financial awareness and can be instrumental in budgeting and spending management.

Easy Fund Transfer Options

A key feature of any effective digital banking app is the ability to transfer funds quickly and easily. Seamless transfers between accounts, whether internal or external, are crucial for managing personal finances.

Look for apps that offer various transfer methods, including transfers using account numbers, mobile numbers, or even QR codes. Real-time processing is also essential for immediate access to funds. Robust security measures such as two-factor authentication should be in place to protect these transactions.

Integrated Budgeting Tools

Effective digital banking apps often include integrated budgeting tools to help users manage their finances. These tools typically track spending across various categories, allowing users to visualize where their money goes.

Some apps provide personalized insights and recommendations based on spending patterns. They may also offer goal-setting features, enabling users to create budgets for specific purposes, such as saving for a down payment or paying off debt. These tools empower users to take control of their financial health and make informed decisions about their money.

Responsive Customer Support

Effective digital banking apps prioritize providing exceptional customer support. Users expect quick resolutions to their queries and problems.

This involves offering multiple support channels such as in-app chat, secure messaging, and 24/7 phone support.

Fast response times and knowledgeable support agents are crucial for maintaining customer satisfaction and trust.

Regular Updates and Enhancements

In the dynamic landscape of financial technology, regular updates and enhancements are crucial for effective digital banking applications. These updates serve several key purposes.

Firstly, they address security vulnerabilities. Cybersecurity threats are constantly evolving, and regular updates patch security loopholes, protecting user data and funds.

Secondly, updates introduce new features and functionalities based on user feedback and technological advancements. This ensures the app remains competitive and relevant, meeting evolving user needs.

Finally, updates improve performance and stability, addressing bugs and optimizing the app for a smoother user experience.

Compatibility with Other Services

Seamless integration with other financial tools and services is a hallmark of a truly effective digital banking app. This interoperability enhances user experience and streamlines financial management.

Key integrations include connectivity with budgeting apps, accounting software, and peer-to-peer payment platforms. This allows users to centralize their finances and gain a holistic view of their financial health.

Compatibility also extends to support for various operating systems and devices. A good app should function seamlessly across different platforms, ensuring accessibility for all users.

Quick Access to Financial Insights

Effective digital banking apps provide instant access to key financial information, empowering users to make informed decisions.

Features like spending trackers categorize transactions and visualize spending patterns. Budgeting tools allow users to set and monitor financial goals. Real-time account balance updates and transaction history offer comprehensive oversight of financial activity. These insights contribute to better financial management.

Some apps even offer personalized financial advice and recommendations based on spending habits, promoting financial wellness and proactive money management. This readily available data facilitates informed financial decisions and cultivates positive financial behaviors.

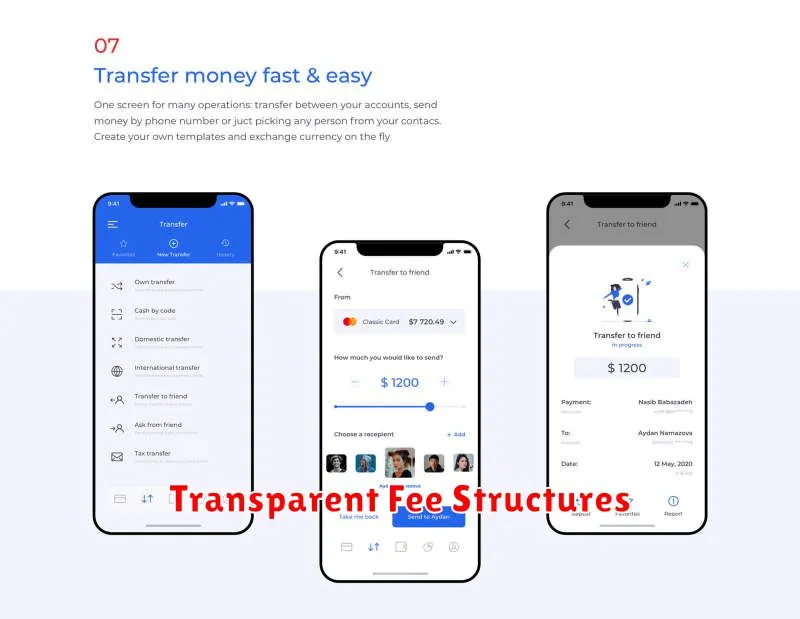

Transparent Fee Structures

A key feature of a successful digital banking app is transparent and easily accessible fee information. Customers should not have to hunt for details about account maintenance fees, overdraft charges, or other potential costs.

Clearly presenting this information builds trust and allows users to make informed decisions about their finances. Ideally, the app should provide a dedicated section outlining all potential fees, presented in a simple, easy-to-understand format.

This fosters a sense of openness and honesty, essential for a positive customer experience.