The banking industry is undergoing a dramatic transformation, fueled by the rapid rise of mobile payments. This shift is impacting everything from how consumers manage their finances to how banks operate and compete. Understanding the intricacies of this evolution is crucial for both individuals and financial institutions. This article will explore how mobile payment technologies are reshaping the banking landscape, discussing the impact on traditional banking services, the emergence of new digital banking solutions, and the critical role of security and regulation in this evolving ecosystem. We will delve into the key trends shaping the future of mobile payments and their profound implications for the banking industry.

From contactless transactions and peer-to-peer (P2P) transfers to mobile wallets and in-app purchases, mobile payments are redefining convenience and accessibility in financial transactions. This evolution presents both opportunities and challenges for traditional banks. They must adapt to the changing needs of their customers, embrace digital innovation, and navigate the complex regulatory landscape. The increasing popularity of mobile payment solutions is forcing banks to rethink their strategies and develop innovative offerings to remain competitive in this dynamic market. This article will analyze the key factors driving this transformation and explore how banks are responding to the rise of mobile payments.

Rise of Mobile Payments

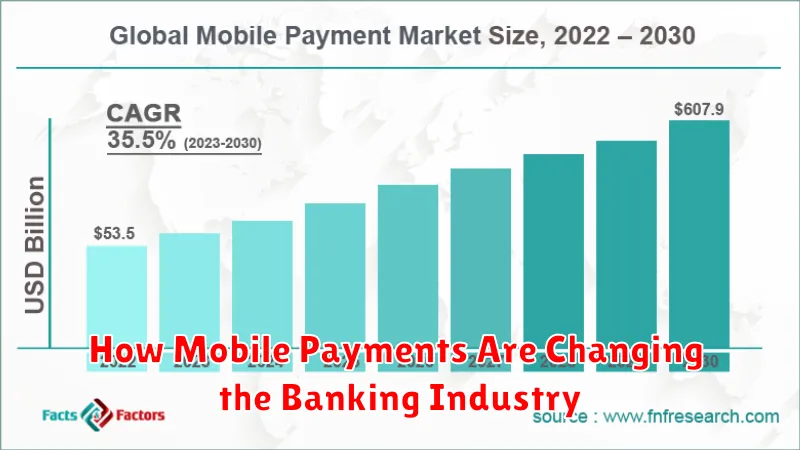

The proliferation of smartphones and advancements in mobile technology have fueled the rapid growth of mobile payments. This shift is largely driven by increased consumer demand for convenience, speed, and accessibility in financial transactions.

Mobile payment solutions, including digital wallets and peer-to-peer (P2P) transfer apps, are increasingly replacing traditional payment methods like cash and checks. This rise has significant implications for the banking industry, challenging established business models and driving innovation in financial services.

The ease of use and ubiquity of mobile devices make mobile payments a readily accessible option for consumers across various demographics. This widespread adoption is reshaping the payment landscape and forcing banks to adapt to the evolving needs of their customers.

Benefits of Mobile Payment Systems

Mobile payment systems offer a multitude of advantages for both consumers and businesses. For consumers, these systems provide convenience, allowing payments anytime, anywhere, eliminating the need for physical cards or cash. This also contributes to increased speed at checkout counters and within apps.

Enhanced security is another key benefit. Many mobile payment platforms utilize tokenization and biometric authentication, reducing the risk of fraud and unauthorized access. Additionally, these systems often provide detailed transaction history, improving budget management and spending awareness.

Businesses benefit from mobile payments through reduced transaction fees compared to traditional card processing. The systems also facilitate improved customer loyalty through integrated rewards programs and personalized offers.

Popular Mobile Payment Options

Several mobile payment options are gaining traction in the current market. These options provide convenient and often secure alternatives to traditional payment methods. Understanding the different types can help consumers and businesses choose the best fit for their needs.

Digital Wallets

Digital wallets, like Apple Pay, Google Pay, and Samsung Pay, store virtual versions of credit and debit cards, enabling contactless payments. They utilize near-field communication (NFC) technology to transmit payment information securely.

Peer-to-Peer (P2P) Payment Apps

P2P apps, such as Venmo, Zelle, and Cash App, facilitate money transfers between individuals. These are particularly useful for splitting bills, paying friends or family, and for small businesses.

Mobile Banking Apps

Many banking institutions offer their own apps with mobile payment functionalities. These apps often allow users to pay bills, transfer funds between accounts, and even deposit checks remotely.

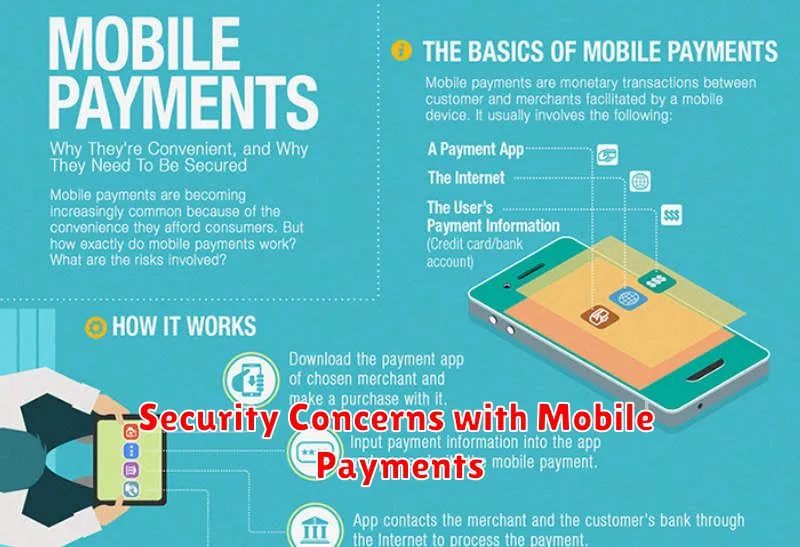

Security Concerns with Mobile Payments

While mobile payments offer convenience, security remains a key concern. The reliance on software and wireless networks introduces vulnerabilities.

Potential risks include data breaches, malware attacks targeting mobile devices, and unauthorized access if a device is lost or stolen.

Consumers must employ strong passwords, enable two-factor authentication, and keep their devices’ software updated to mitigate these risks.

Impact on Traditional Banking

Mobile payments are significantly impacting traditional banking operations. The rise of peer-to-peer (P2P) transactions and digital wallets is diminishing the role of banks as intermediaries in many transactions. This reduces the fees banks collect and necessitates a shift in business models.

Furthermore, the demand for physical branches is declining as customers increasingly manage their finances digitally. This translates to potential cost savings for banks, but also requires investments in improving and securing digital infrastructure.

Finally, the increasing availability of financial data through mobile payment platforms presents both opportunities and challenges. Banks can leverage this data to offer personalized services, but they must also address growing concerns about data privacy and security.

Global Adoption Trends

Mobile payment adoption exhibits significant regional variations. Asia leads the world in mobile payment usage, driven by platforms like Alipay and WeChat Pay. Africa also demonstrates strong growth, primarily through mobile money services like M-Pesa, often leapfrogging traditional banking infrastructure.

In contrast, North America and Europe have seen slower adoption rates, although contactless payments and mobile wallets are gaining traction. Factors influencing these trends include existing financial infrastructure, consumer behavior, and regulatory landscapes.

Integration with Digital Wallets

Digital wallets are fundamentally changing how consumers interact with financial institutions. These wallets, such as Apple Pay and Google Pay, offer a seamless and secure way to store payment information and conduct transactions. Integration with these platforms has become crucial for banks to remain competitive and relevant.

By incorporating digital wallet functionality, banks provide customers with added convenience. This streamlined payment experience eliminates the need for physical cards, improving transaction speed and reducing friction at the point of sale. Furthermore, enhanced security measures, such as tokenization and biometric authentication, offer greater protection against fraud.

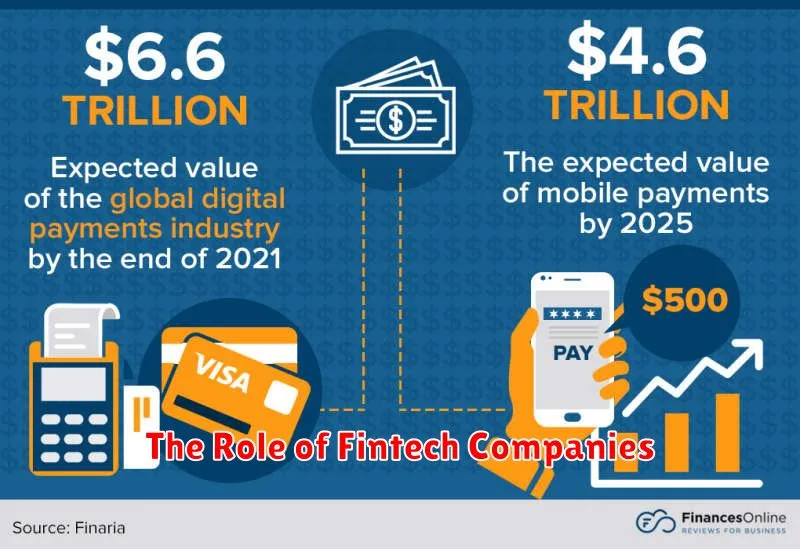

The Role of Fintech Companies

Fintech companies play a critical role in the mobile payment revolution. They are often the driving force behind developing and implementing the technology that facilitates these transactions. Their innovative solutions bypass traditional banking infrastructure, offering faster, more convenient, and often cheaper payment options.

These companies are disrupting the status quo by introducing new business models and technologies. They offer services like mobile wallets, peer-to-peer (P2P) payment platforms, and contactless payment solutions. This competition pushes established banks to adapt and innovate to remain competitive.

Regulatory Challenges

The rapid growth of mobile payments presents significant regulatory challenges for governments and financial institutions. Compliance with existing regulations, such as anti-money laundering (AML) and know-your-customer (KYC) rules, becomes more complex in a mobile environment.

Data security and privacy are paramount concerns. Regulators must ensure robust security measures are in place to protect sensitive user data from fraud and breaches. Balancing innovation with consumer protection is a key challenge.

Interoperability is another important aspect. Establishing clear standards and frameworks for mobile payment systems promotes competition and prevents fragmentation of the market. Regulators must navigate these complex issues to foster a safe and efficient mobile payment ecosystem.

The Future of Mobile Payments

The future of mobile payments appears poised for substantial growth and transformation. Several key trends are expected to shape this evolution.

Biometric authentication will likely become even more prevalent, enhancing security and convenience. Integration with wearable technology will further streamline transactions, allowing payments with smartwatches or other devices.

The expansion of mobile wallets into new markets, especially developing economies with high mobile penetration rates, will drive significant adoption. Increased merchant acceptance, fueled by lower transaction fees and improved infrastructure, will further solidify mobile payments as a dominant payment method.