In today’s rapidly evolving digital landscape, peer-to-peer (P2P) payments have become an increasingly popular method for transferring funds directly between individuals. Understanding P2P payments is crucial in navigating the modern financial world. This article will delve into the mechanics of P2P transactions, exploring the various platforms available, discussing the security implications, and outlining the benefits and drawbacks of utilizing this innovative technology. From splitting the cost of a meal with friends to paying rent or settling debts, P2P payment apps offer a convenient and efficient alternative to traditional banking methods.

Peer-to-peer payment systems offer a range of features, including instant transfers, low fees, and user-friendly interfaces. This article will examine the key players in the P2P payments market, comparing and contrasting popular platforms such as Venmo, Zelle, PayPal, and Cash App. We will also discuss the regulatory landscape surrounding P2P transactions, highlighting the importance of understanding the legal and security considerations associated with this rapidly growing sector of the financial technology industry. Gain a comprehensive understanding of peer-to-peer payments and how they can impact your personal finances.

What Are Peer-to-Peer Payments?

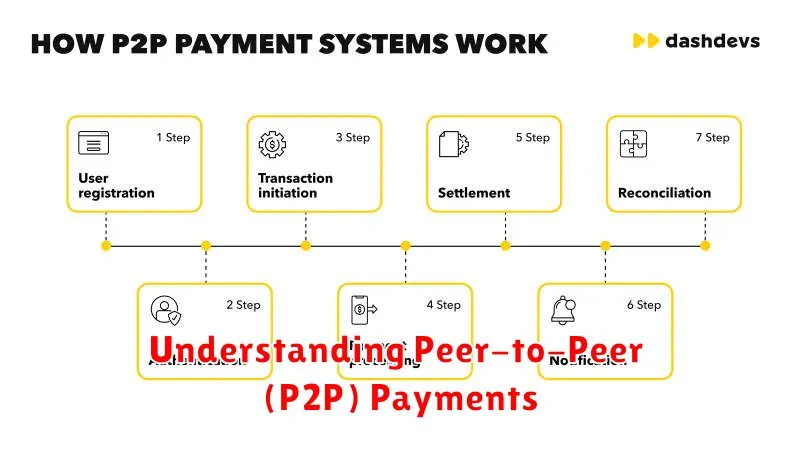

Peer-to-peer (P2P) payments are electronic money transfers made between two individuals using a mobile device or computer.

These transactions typically bypass traditional financial institutions like banks, allowing for quick and convenient payments for various purposes. These can include splitting bills, paying rent, sending gifts, or reimbursing friends.

P2P payment apps connect directly to a user’s bank account or debit card to facilitate these transfers. They often include features such as transaction histories and account balances.

Popular P2P Payment Apps

Several P2P payment apps dominate the market, each offering slightly different features and functionalities. Choosing the right one depends on individual needs and preferences. Some of the most popular options include:

Leading Apps

-

Venmo: Known for its social feed feature, Venmo is popular amongst friends and family for splitting bills and sharing payments.

-

PayPal: A long-standing platform for online transactions, PayPal also offers a robust P2P payment system with a broad user base.

-

Cash App: This app allows users to send and receive money, invest in stocks, and even buy Bitcoin.

-

Zelle: Often integrated directly into banking apps, Zelle facilitates quick and easy transfers between bank accounts.

These apps generally allow users to link their bank accounts or debit cards to facilitate transactions. They also provide varying levels of security and fraud protection.

Advantages of Using P2P Payments

P2P payment systems offer a multitude of advantages over traditional methods. One key benefit is speed. Transactions are typically completed almost instantly, allowing for quick payments and fund transfers.

Convenience is another major advantage. Users can send and receive money anytime, anywhere, directly from their mobile devices. This eliminates the need for physical checks or trips to the bank.

Often, P2P platforms offer low or no fees, particularly for transfers between users of the same platform. This can result in significant cost savings compared to traditional banking fees.

How Secure Are P2P Transactions?

Security is a primary concern with P2P transactions. While these platforms utilize various security measures, the level of safety depends on several factors.

Most P2P platforms employ encryption to protect data in transit. They also often use multi-factor authentication and fraud detection algorithms. However, user practices also play a crucial role.

Choosing strong passwords, being wary of phishing scams, and avoiding transactions with unknown individuals are essential for maximizing security. It’s also crucial to understand the platform’s specific security measures and user protections.

Fees and Limits Associated with P2P

Peer-to-peer (P2P) payment platforms often come with associated fees and transaction limits. Understanding these is crucial for managing your finances effectively.

Fees can vary depending on the platform, payment method, and transaction type. Some platforms charge a small percentage per transaction, while others may have fixed fees for certain actions, like instant transfers or international payments. Some platforms offer free transactions for certain payment methods, such as using a linked bank account.

Transaction limits also exist to mitigate risk and comply with regulations. These limits can be daily, weekly, or monthly, restricting the amount of money you can send or receive. These limits can vary based on account verification status. Higher limits are often available after providing additional identification.

International P2P Payments

International P2P payments facilitate cross-border money transfers between individuals. These transactions often involve different currencies and regulatory frameworks.

Several factors influence the cost and speed of international P2P payments, including the countries involved, the payment method used, and the amount being transferred. Exchange rates and transaction fees are key considerations. Some providers may offer more favorable rates or faster processing times than traditional banking methods.

Security is paramount for international transfers. Users should carefully vet the platform or service they use and be aware of potential scams and fraudulent activities.

Risks to Be Aware Of

While P2P payment systems offer convenience, it’s crucial to be aware of potential risks. Fraud is a significant concern. Scammers may impersonate legitimate sellers or buyers, leading to financial losses.

Privacy is another important consideration. Understand how your personal data is collected, used, and shared by the P2P platform.

Limited buyer/seller protection can be a drawback compared to traditional payment methods like credit cards. Disputes can be challenging to resolve, potentially leaving you with little recourse if something goes wrong.

Tips for Safe Transactions

When engaging in P2P transactions, prioritizing safety is paramount. Following these tips can help ensure secure and seamless payment experiences.

Verify the recipient. Double-check the recipient’s information before initiating any transaction. Confirm their identity and ensure you’re sending money to the correct person. Typos or similar-looking usernames can lead to misdirected funds.

Use strong passwords and two-factor authentication. Protect your P2P account with a robust password and enable two-factor authentication whenever possible. This adds an extra layer of security, making it harder for unauthorized access.

Be wary of scams. Be cautious of unsolicited requests or offers that seem too good to be true. Avoid clicking on suspicious links and report any fraudulent activity immediately to the platform provider.

Future Trends in P2P Payments

The future of P2P payments is poised for continued growth and innovation. Real-time payments are becoming increasingly prevalent, offering instant transfer capabilities. This trend is fueled by advancements in technology and increasing consumer demand for faster transactions.

Increased security measures, including biometric authentication and enhanced encryption, are expected to become standard. This is crucial for maintaining user trust and mitigating fraud risks as P2P platforms handle larger transaction volumes.

Integration with other financial services is another key trend. We can anticipate tighter integration with budgeting apps, investment platforms, and even social media channels. This will create a more seamless and holistic financial experience for users.

The expansion into international markets is also on the horizon, allowing for cross-border P2P transactions with greater ease and efficiency. This will facilitate global commerce and personal remittances.

Choosing the Right P2P Service

Selecting the right peer-to-peer (P2P) payment service depends on your individual needs and preferences. Security is paramount, so ensure the service uses strong encryption and offers fraud protection. Consider the fees associated with transactions, especially for international transfers or business use.

Transfer speed is another crucial factor. Some services offer instant transfers, while others may take several business days. Think about where your contacts use P2P services. Availability and convenience are key; choose a service widely adopted by your friends, family, or clients.

Finally, examine the service’s features. Some offer budgeting tools, bill splitting, or the ability to link to bank accounts or debit cards. Choosing the right P2P service involves evaluating these factors to find the best fit for your financial needs.