In today’s increasingly digital world, digital banking fraud is a serious and growing threat. Protecting yourself from these sophisticated scams is crucial to safeguarding your financial well-being. This article will provide essential guidance on how to recognize, avoid, and respond to digital banking fraud, covering common tactics such as phishing, malware, and identity theft. Understanding the risks and taking proactive steps is paramount in maintaining the security of your online banking activities and protecting your hard-earned money from fraudulent activities. Learn how to enhance your digital banking security and stay one step ahead of potential threats.

Digital banking fraud can take many forms, impacting individuals and businesses alike. From unauthorized access to accounts and stolen credentials to sophisticated phishing schemes and malware attacks, the methods employed by criminals are constantly evolving. This article will explore various types of digital banking fraud, offering practical tips and best practices to help you secure your accounts and transactions. We’ll discuss the importance of strong passwords, multi-factor authentication, and recognizing suspicious emails and messages. By implementing these strategies, you can significantly reduce your risk of becoming a victim of online banking fraud and protect your financial future.

Recognize Common Fraud Schemes

Phishing: Fraudsters impersonate legitimate organizations via email, text, or phone calls to trick you into revealing sensitive information like usernames, passwords, and social security numbers. Be wary of unsolicited requests for personal information.

Smishing and Vishing: Similar to phishing, but smishing uses text messages (SMS) and vishing uses phone calls (voice). Never click on links in suspicious texts or provide information over the phone unless you initiated the contact.

Malware: Malicious software installed on your devices can steal data or control your online banking sessions. Keep your software updated and use reputable antivirus/antimalware programs.

Set Up Transaction Alerts

Transaction alerts are a crucial tool in fraud prevention. They provide real-time notifications of activity on your accounts, enabling you to quickly identify and report any unauthorized transactions. Set up alerts for a variety of activities, such as:

- Purchases exceeding a specific amount

- ATM withdrawals

- Balance changes below a certain threshold

- Online logins

By receiving immediate notifications, you can take swift action if you notice any suspicious activity. Contact your bank immediately to report and investigate any fraudulent transactions.

Use Multi-Factor Authentication

Multi-factor authentication (MFA) adds an extra layer of security to your online banking accounts. It requires you to verify your identity using multiple factors, making it significantly harder for fraudsters to gain access even if they have your password.

Typically, MFA involves two or more of the following:

- Something you know (e.g., your password)

- Something you have (e.g., a one-time code sent to your phone or email)

- Something you are (e.g., biometric verification like fingerprint or facial recognition)

Enable MFA on all your financial accounts. It’s a simple yet powerful way to protect yourself from unauthorized access.

Regularly Update Passwords

Password management is crucial for online banking security. Regularly updating your passwords significantly reduces the risk of unauthorized access. Aim to change your banking passwords every three to six months.

Choose strong and unique passwords. Avoid easily guessable information like birthdays or pet names. Instead, opt for a combination of uppercase and lowercase letters, numbers, and symbols. Consider using a password manager to help generate and securely store complex passwords.

Never reuse the same password across multiple accounts, especially your online banking. If one account is compromised, all accounts using the same password become vulnerable.

Avoid Public Wi-Fi for Banking

Public Wi-Fi hotspots are convenient, but they also present a significant security risk for online banking. These networks are often unsecured, meaning your data is not encrypted and is vulnerable to interception by cybercriminals. Hackers can potentially access your login credentials, account numbers, and other sensitive information.

Instead of using public Wi-Fi, opt for secure connections when accessing your banking information. Use your mobile phone’s cellular data or wait until you have access to a trusted private network. This simple precaution can greatly reduce your risk of becoming a victim of digital banking fraud.

Verify Communications from Banks

Never respond directly to unsolicited emails or text messages that request personal or financial information. Always independently verify communications purporting to be from your bank.

Contact your bank through official channels. This could involve calling the customer service number listed on the back of your debit/credit card or visiting the bank’s verified website. Do not use contact information provided in the suspicious communication.

Scrutinize emails and texts carefully. Look for inconsistencies in branding, grammar, and tone. Be wary of urgent requests or threats. Legitimate financial institutions will not pressure you into providing sensitive information through unsecured channels.

Keep Your Devices Secure and Updated

Maintaining strong security on your devices is crucial for protecting yourself against digital banking fraud. Always keep your operating system, apps, and web browsers updated to their latest versions. These updates often include critical security patches that address known vulnerabilities exploited by fraudsters.

Enable strong passcodes or biometrics on all your devices. Avoid using easily guessable passwords and consider using a reputable password manager to generate and securely store complex passwords. Regularly review the security settings on your devices to ensure they are configured optimally for protection.

Monitor Account Activity Regularly

Regularly monitoring your account activity is crucial for detecting fraudulent transactions quickly. This allows you to identify and report any unauthorized activity before significant damage is done.

Make it a habit to review your account statements, whether online or paper, at least once a month. Look for any transactions you don’t recognize. Many banks also offer real-time alerts via email or text message for various account activities, such as withdrawals, deposits, and balance changes. Setting up these alerts can provide an extra layer of security.

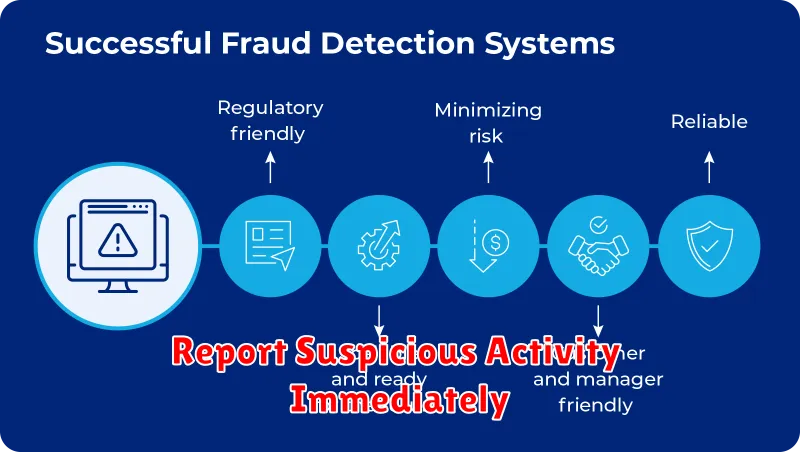

Report Suspicious Activity Immediately

Time is of the essence when dealing with potential fraud. If you notice any suspicious activity on your account, such as unauthorized transactions, unfamiliar login attempts, or phishing emails, report it to your bank immediately.

Early reporting can minimize potential losses and help your bank take swift action to secure your account. Don’t hesitate to contact your bank’s customer service department or fraud hotline. Be prepared to provide details about the suspicious activity, including dates, times, amounts, and any other relevant information.

Educate Yourself on Latest Scams

Staying informed about current fraud trends is crucial for protecting your finances. Scammers constantly adapt their tactics, so awareness is your first line of defense.

Pay close attention to announcements from your bank and reputable financial news sources. These resources often provide details about new scam methods and offer practical advice on how to avoid them.

Common current scams include phishing emails, smishing texts, and vishing calls. Understanding how these scams operate can help you recognize and avoid them.