In today’s fast-paced world, mobile banking apps have become indispensable tools for managing finances. The convenience of accessing your bank account, making payments, and transferring funds from your smartphone is undeniable. However, this convenience also comes with potential risks. It’s crucial to understand how to safely use these banking apps to protect your sensitive financial information. This article will provide a comprehensive guide on how to securely navigate the world of mobile banking on your smartphone.

From choosing a secure banking app to understanding the potential threats and implementing the right security measures, we’ll cover everything you need to know. This guide emphasizes the safe usage of banking apps, highlighting security measures such as strong passwords, two-factor authentication, and recognizing phishing scams. By following these guidelines, you can confidently utilize the convenience of mobile banking while keeping your financial information safe and secure.

Download from Official Sources Only

Always download banking apps from official sources. This primarily includes your device’s official app store, such as the Google Play Store for Android or the Apple App Store for iOS devices. Downloading from these trusted platforms significantly reduces the risk of installing a counterfeit or malicious app.

Avoid downloading banking apps from third-party websites or through unofficial links. These sources are not vetted for security and may distribute modified apps containing malware designed to steal your financial information. Sticking to official app stores ensures that the app you’re installing is legitimate and has undergone security checks.

Regularly Update Your Apps

Keeping your banking apps updated is crucial for maintaining a secure mobile banking experience. Updates often include critical security patches that address vulnerabilities discovered in previous versions. Failing to update your apps can leave your device susceptible to malware and other security threats.

Enable automatic updates in your device’s settings whenever possible. This ensures you receive the latest security enhancements and bug fixes as soon as they are released. If automatic updates aren’t feasible, make it a habit to manually check for updates regularly, at least once a week.

Use Strong App Passwords

Never reuse the same password you use for other accounts, especially your online banking login. Using unique, strong passwords for each app isolates potential breaches. If one app is compromised, your other accounts remain safe.

A strong password should be at least 12 characters long and incorporate a mix of uppercase and lowercase letters, numbers, and symbols. Avoid easily guessable information like your name, birthday, or common words.

Consider using a password manager to generate and securely store strong, unique passwords for all your apps.

Avoid Public Wi-Fi Networks

Public Wi-Fi networks, while convenient, pose a significant security risk for banking app usage. These networks are often unsecured, meaning your data is vulnerable to interception by cybercriminals.

Hackers can use various techniques to eavesdrop on your activity while connected to public Wi-Fi, potentially gaining access to your login credentials, transaction details, and other sensitive financial information.

It’s strongly recommended to use your cellular data network or wait until you’re connected to a secure, private Wi-Fi network before accessing your banking app. This significantly reduces the risk of compromise.

Activate Security Notifications

Security notifications are crucial for monitoring your banking app’s activity and detecting any unauthorized access. Enable all possible notifications offered by your banking app.

These notifications may include:

- Login alerts

- Transaction alerts

- Password change notifications

- Balance updates

By receiving these alerts, you can immediately identify and respond to suspicious activity, minimizing potential losses and protecting your financial information.

Monitor Transaction History Regularly

Regularly reviewing your transaction history is crucial for maintaining a secure banking experience. It allows you to quickly identify any unauthorized or suspicious activity.

Make it a habit to check your transactions at least once a week, if not more frequently. Look for any transactions you don’t recognize, even small ones. Early detection of fraudulent activity can minimize potential losses.

Most banking apps offer real-time transaction notifications. Enabling these alerts can provide immediate notification of any activity on your account, allowing you to react swiftly if necessary.

Use Biometric Authentication

Whenever possible, enable biometric authentication for your banking app. This adds an extra layer of security, making it much harder for unauthorized individuals to access your account. Most modern smartphones offer fingerprint or facial recognition.

Biometrics provide a convenient and secure way to protect your financial information. Even if your phone is lost or stolen, your accounts remain protected. Ensure your device’s biometric settings are properly configured and your chosen biometric data is registered accurately.

Limit App Permissions

Mobile banking apps often request access to various features on your smartphone, such as your location, contacts, or camera. While some of these permissions are necessary for the app to function correctly, others may not be essential. Limiting app permissions is a crucial step in enhancing your security.

Review the permissions requested by your banking app. If a permission seems unnecessary for the app’s core functionality, deny it. You can usually manage app permissions in your smartphone’s settings. For example, a banking app likely doesn’t need access to your microphone or photos. By granting only the essential permissions, you minimize the potential impact of a security breach.

Clear App Data if Phone is Lost

If your phone is lost or stolen, clearing your banking app data remotely is a critical security measure. This action helps protect your financial information by wiping sensitive data stored locally on the device.

Many banking apps offer a remote wipe feature. Check with your bank to understand their specific procedures. Some banks allow you to clear app data through their website after logging into your account. Other institutions might require you to contact customer support directly. Acting swiftly is important to minimize potential risks.

Clearing app data will log you out of the app on the lost device and may also delete locally stored transaction history. This adds an extra layer of security, even if the thief bypasses your phone’s lock screen.

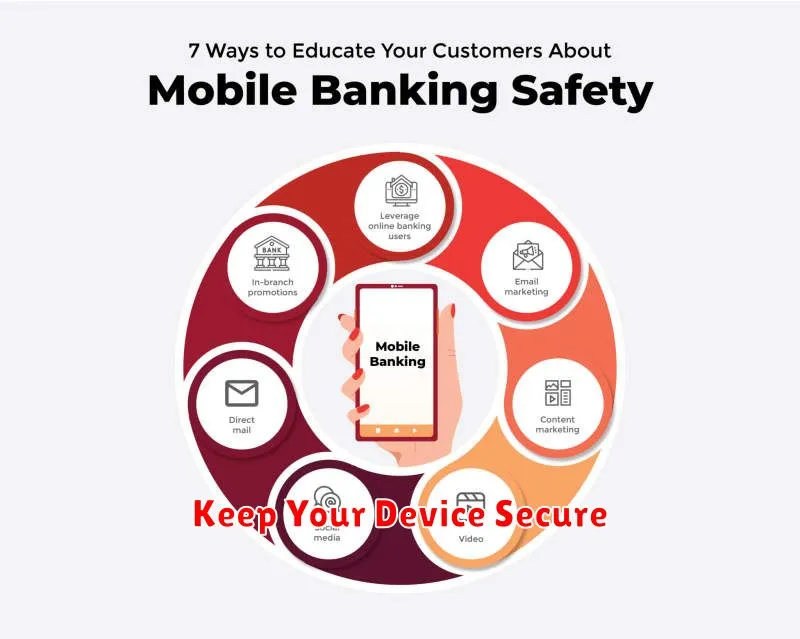

Keep Your Device Secure

Securing your device is paramount to safe mobile banking. Always use a strong passcode or biometric lock, like fingerprint or facial recognition. This prevents unauthorized access should your phone be lost or stolen.

Keep your device’s operating system and apps updated. These updates often include crucial security patches that protect against newly discovered vulnerabilities.

Avoid downloading apps from untrusted sources. Stick to official app stores like Google Play or the Apple App Store. Malicious apps can steal your banking credentials.